IFA 2025, rebranded as Innovation For All last year, showcased a broad spectrum of consumer electronic products. The event traditionally marks the kick-off for retail promotions leading into the year’s main sales season – beginning with Black Friday, followed by Singles’ Day and Amazon Prime Days, and extending through Christmas. This year, AI was the central innovation driver across all categories: TVs, smartphones, audio equipment, fitness gear, kitchen and household devices, hobby technologies, robotics and all kinds of gadgets.

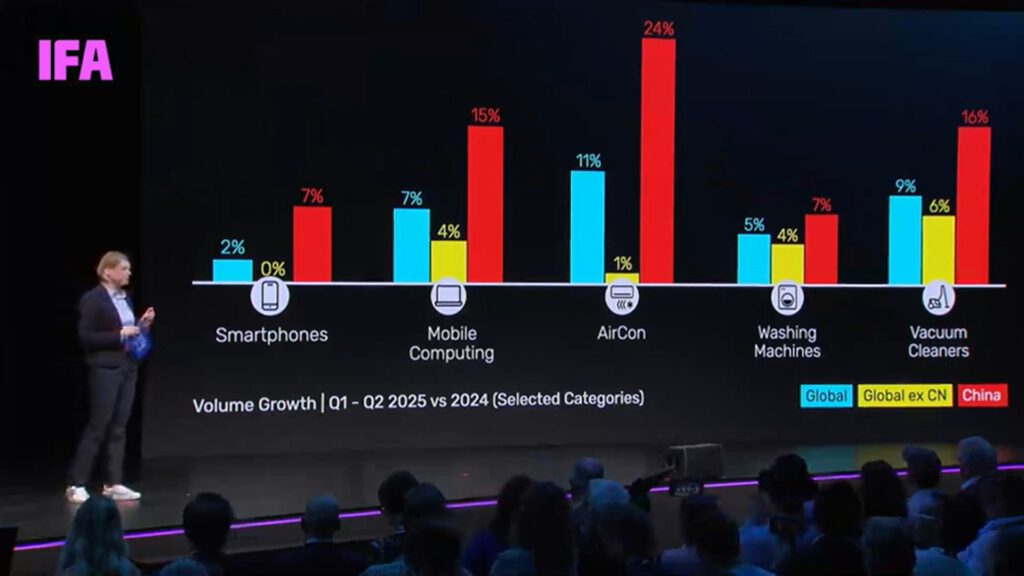

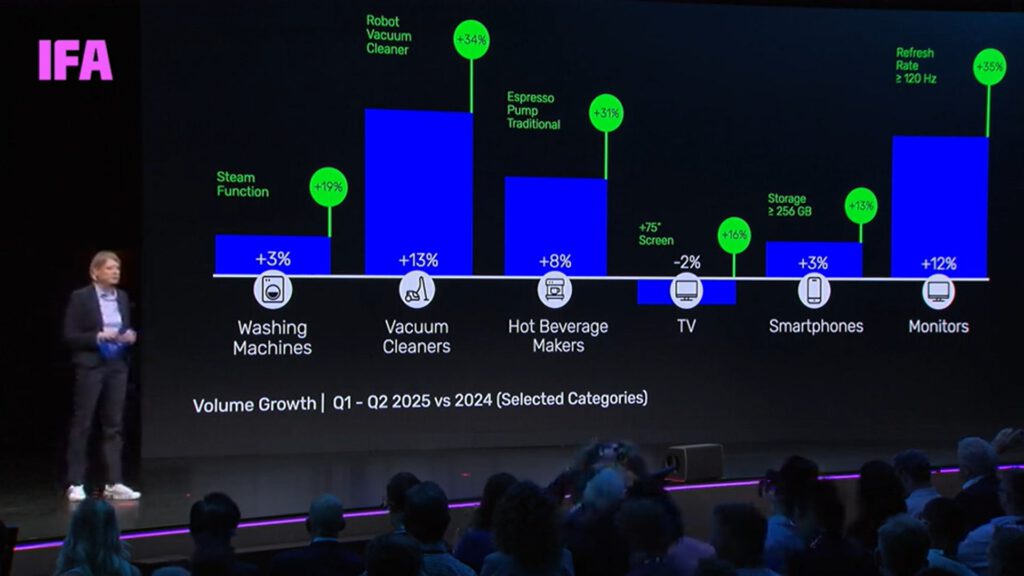

Retailers and manufacturers are navigating an increasingly turbulent global market, shaped by a sluggish post-pandemic recovery, ongoing tariff restrictions, and uncertainty around potential trade conflicts. In this environment, China and Asia are gaining importance both as growth engines for consumer demand and as primary production hubs for electronics. The recent acquisition of Europe’s largest electronics retail chain by a Chinese company cast a notable shadow over the show.

During the post-pandemic rebound, Chinese companies gradually replaced several traditional brands on the show floor. This shift has proven lasting. Major players in telecommunications and television – once the backbone of IFA – did not return in full force. Today, Chinese brands dominate the exhibition, alongside established competitors from Korea, Japan and Taiwan, often highlighting familiar themes such as TV screens, MicroLEDs, and laser projection technologies.

While the TV market is losing momentum, new applications for screen technologies are surging. AI-powered smart glasses – both with and without transparent displays – are emerging as stylish, affordable wearables. Video glasses increasingly replace monitors and smartphone screens, offering spatial arrangements of multiple virtual displays and augmented reality features. Chinese firms, from startups like Rokid to established names like TCL, are competing with American Tech companies in this space. Prices are dropping fast: competitive alternatives to the $450 Meta-RayBan AI glasses are now available for $200–$300 on the show floor, with factory-level Chinese replicas starting as low as $30 in IFA’s Global Markets area.

Reflecting trends first seen at CES at the beginning of this year, XR and VR continue to diverge. Smart glasses and AR prototypes are positioned for everyday use, while VR remains focused on gaming, training, and industrial applications. Apart from accessories and arcade-style installations, IFA 2025 saw no major VR product launches. However, gaming took center stage with glasses-free 3D displays, high-end gaming gear, and an indie showcase presented in partnership with Berlin Games Ground.

IFA 2025 underscored how AI and Asian innovation are reshaping consumer electronics, shifting the spotlight from traditional TV-centric displays to smart wearables, AR applications, and gaming. The event highlighted both the opportunities and uncertainties in a market increasingly defined by global competition, deterioration, and rapid technological change.